Author: Ed Elson

Compiled by: Deep Tide TechFlow

Deep Tide Introduction: Last week, the software industry lost $1 trillion in market value, falling 14% in a single week and about 20% year-to-date. Major names like Shopify, Atlassian, Salesforce, and Adobe all plummeted.

Reason? Anthropic released Claude Cowork and its plugins, and OpenAI also launched similar tools. Investors panicked and sold off, believing that "AI killed software."

But Ed Elson believes this is irrational panic; we've seen this movie before: When ChatGPT emerged in 2022, Google fell 40%; when TikTok appeared, Meta dropped 70%; when DeepSeek came out, Nvidia declined 30%.

The result? These companies have since risen 630%, 270%, and 55% from their lows, respectively. On Thursday, he bought Adobe, Salesforce, ServiceNow, and Microsoft, citing high switching costs, strong AI integration capabilities, and extremely low valuations.

Full text below:

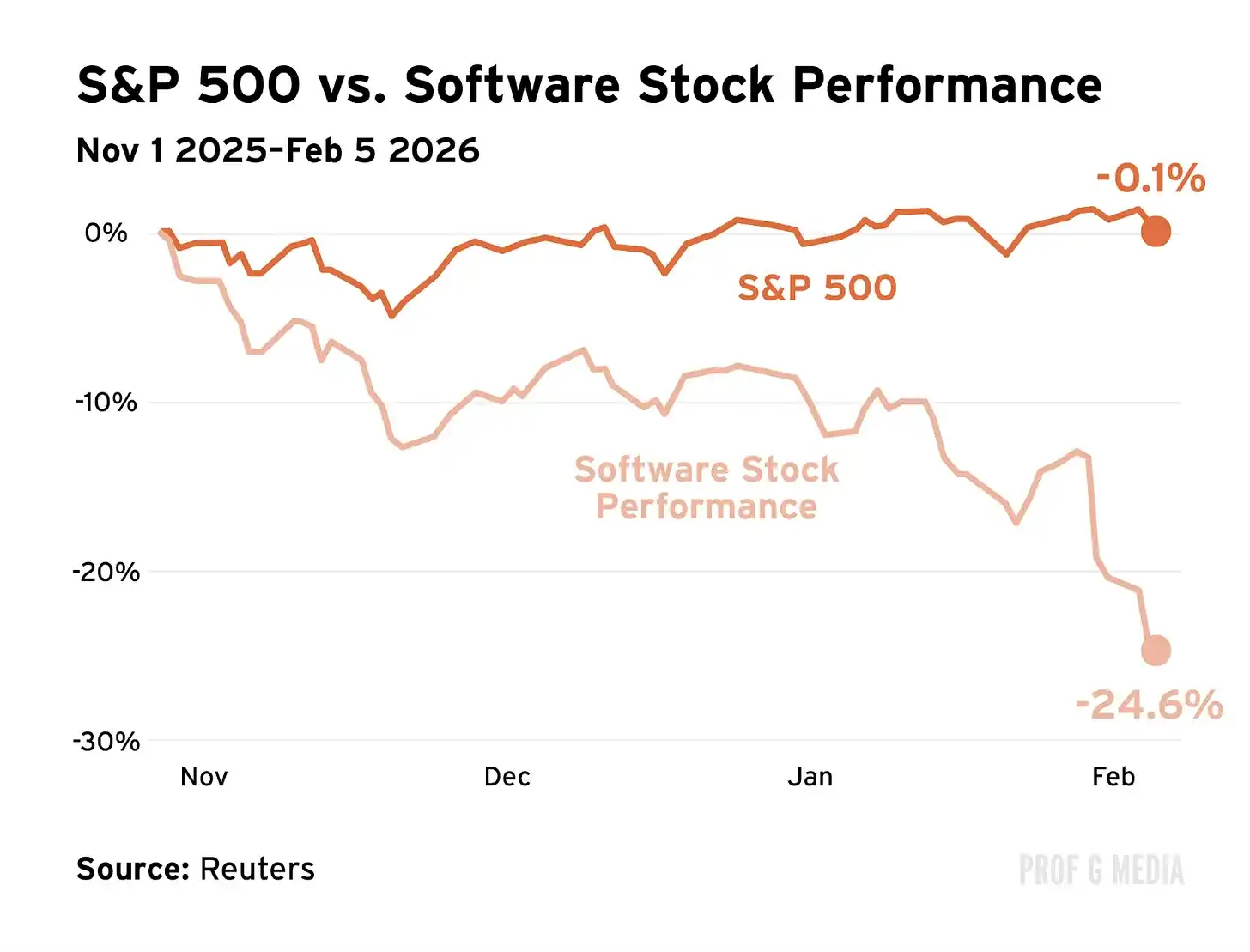

Last week, we witnessed what can be called a massacre. $1 trillion in market value was wiped out. Selling activity hit historic highs. Companies lost 10%, 20%, 30% of their value. If you were looking at your retirement account, you might not have noticed: the S&P 500 was only slightly down. That's because the slaughter happened in one very specific place—an industry that has dominated portfolios for decades and many thought was invincible: software.

All the biggest names went into free fall: Shopify, Atlassian, Salesforce, Adobe, the list goes on. The software industry lost about 14% of its value in just one week. Year-to-date, that number is now around 20%.

Why did this happen? Because of AI. A few weeks ago, Anthropic released a new AI tool, Claude Cowork. Then (last week) they released new plugins for specific fields: legal work, sales, finance, marketing, etc. OpenAI quickly released similar tools.

Investors quickly asked themselves an important question: Isn't this what every traditional software company does? After that: Did AI just kill software? Finally, their conclusion: Sell everything.

Déjà Vu

We've seen this movie before. In 2022, an AI tool called ChatGPT took the internet by storm. Investors asked themselves an important question: Isn't this what Google does? Within months, Wall Street decided search was dead. Google lost up to 40% of its value that year.

Before that, a social media app called TikTok arrived. Investors asked themselves: Isn't this what Meta does? Once Meta reported a user decline, $230 billion in market value vanished, the largest 24-hour sell-off in stock market history. Meta went on to lose up to 70% of its value.

More recently, a Chinese AI model called DeepSeek went viral. Investors asked themselves: Isn't this what OpenAI does? OpenAI isn't publicly traded, so the sell-off wasn't visible. However, the fear echoed into the public markets. Nvidia lost 30% of its value over the next few months.

Since these market-breaking events, Nvidia, Meta, and Google have risen 55%, 270%, and 630% from their lows, respectively. DeepSeek wasn't the domestic AI killer investors thought it was. After TikTok, Meta learned from it and launched its own version, Reels, which now has a 2 billion active user base. After ChatGPT, Google doubled down on AI and eventually launched Gemini, ChatGPT's fastest-growing competitor. Google is now considered the undisputed AI heavyweight champion.

The pattern here is simple. A transformative technology arrives. Investors indiscriminately decide "it's over." They aren't wrong about the technology, but they overestimate its impact. They panic-sell, assuming the game is zero-sum. Valuations plummet. Suddenly, America's greatest companies are on a 50% discount. Meanwhile, they continue to deploy armies of talent and capital to sharpen their focus and neutralize the competition. Earnings grow larger, valuations soar again. Years later we look back at the charts and think: What were we thinking? That is, all of us who sold.

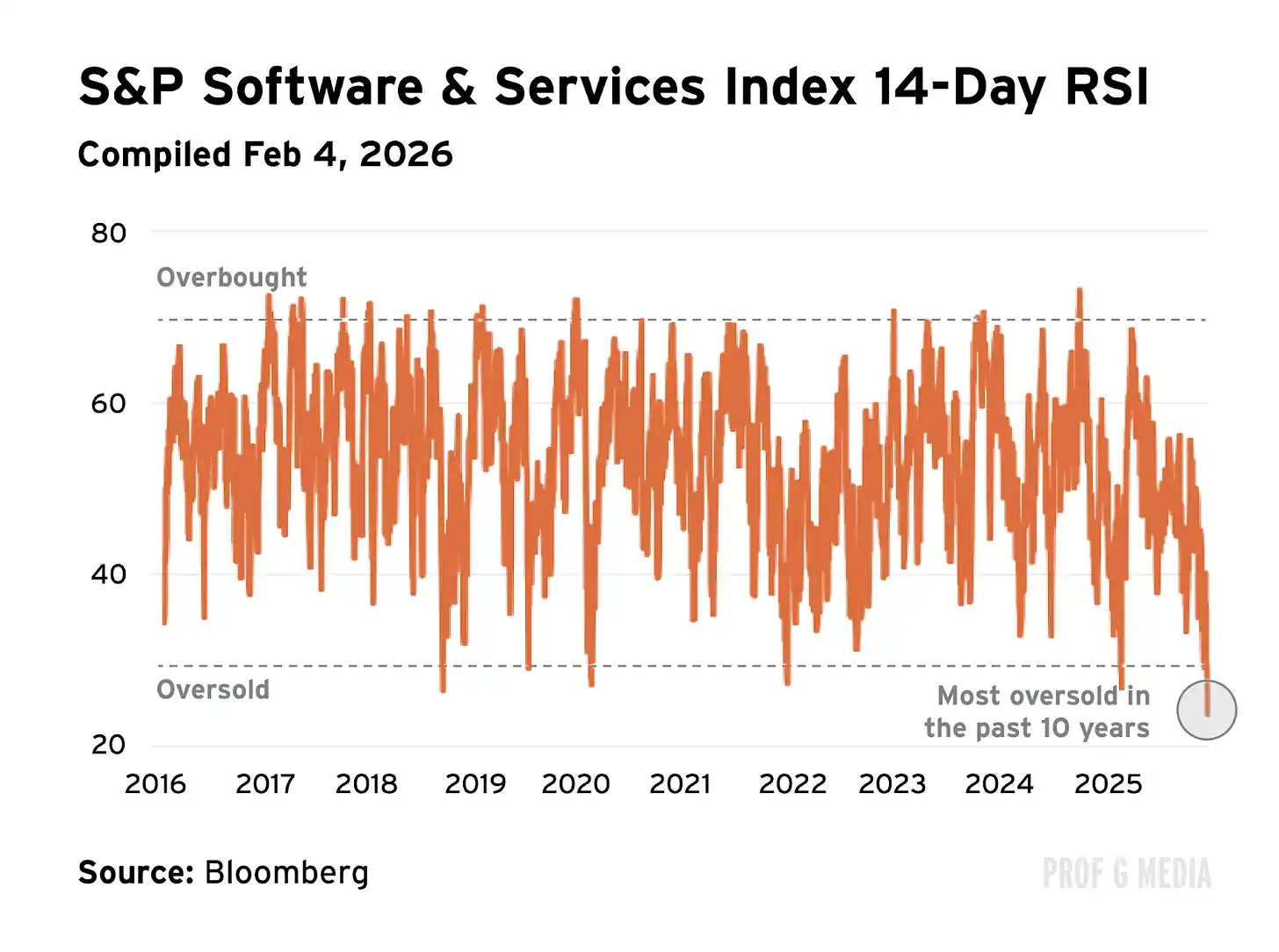

There's Panic, and Then There's This

I believe what happened in the software industry last week is no different. This isn't a correction; it's a full-blown crisis. To paint you a picture: The Relative Strength Index (RSI) is a formula that captures buying and selling pressure. An RSI score of 30 means a stock is oversold. Last week, the average RSI for software stocks hit 18. I don't usually like technical analysis, but in this case, it describes what we saw well: Armageddon.

On one hand, the concerns are valid. Will AI disrupt software? Yes. Will it put pressure on margins? Absolutely. Do SaaS companies have to rethink their distribution? Without a doubt.

On the other hand, this isn't what the market told us last week. The market told us software is over—no matter who you are or what you sell. This stance is more questionable. While I was initially willing to listen, I concluded it's not coming from a place of rationality but from a place of fear. In other words: it's irrational.

Reality Check

First, nothing is stopping software companies from integrating AI. The ChatGPT vs. Google story is the perfect example. Just because OpenAI had a more exciting product doesn't mean Google is dead. Google simply enhanced their existing product with AI features (Google Search is now the primary AI interface in the US), then built their own AI chatbot. If SaaS companies were just ignoring AI, the shorts might have a point, but they're not. Software companies are embracing AI across the board.

Second, investors underestimate how massive a pain it is to cancel an enterprise SaaS contract. In more business terms: switching costs are high. The average software sales process can take over half a year to finalize and must be approved by ten different decision-makers. The process is grueling because the contracts are long. That's not to mention the associated financial costs. For example, a typical Salesforce contract can't be canceled for free—the enterprise must pay 100% of the remaining contract value. In other words, switching your software provider as a business is a very big deal. If you're going to do it, you better have an extremely compelling reason why it's worth it. Plus, all the other executives at the company have to agree with you. Painful. Really. Painful.

Finally, in enterprise software, security concerns are huge. Signing a software agreement essentially means handing all your private data to a third party and praying they don't lose, use, or misuse it. In other words, it requires trust. This is the top priority for 80% of IT leaders. More importantly, trust can't be coded out in a day. Trust has to be built over years, even decades. It requires long-term relationships and a massive track record of success. These are things traditional companies have that Anthropic does not. Trust and security are a huge moat that cannot be overlooked.

Time to Buy

By Thursday afternoon, I had seen enough. I had two voices in my head. 1) Warren Buffett, who told me to be greedy when others are fearful. 2) Mark Mahaney, who told me to find "DHQ" (Dislocated High Quality companies). I decided it was time to buy and gave myself two options.

Option 1: Buy the entire software basket. I looked at IGV, an ETF of all the big software names, and it had been crushed. There might be a few losers in there, but the average multiple had fallen to a point where I felt I really couldn't go wrong. This was the safe choice.

Option 2: Stock pick. That is, personally identify a handful of software names I believe are high-quality companies. This was the riskier option, as I risked being wrong and picking losers. Still, I chose Option 2 because I was feeling bold.

DHQ (Dislocated High Quality Companies)

On Thursday morning, I bought three stocks: Adobe, Salesforce, and ServiceNow. After that, I bought one more: Microsoft. Note: I am not a financial advisor, this is not financial advice—I'm just telling you what I did. My reasoning is as follows.

1. Adobe

Adobe currently has a P/E ratio of 16, less than half its five-year average. It's also almost half the average P/E of the S&P 500. It's incredibly cheap. The consensus is that AI will make it irrelevant, but this ignores two key facts.

1) Adobe is already heavily integrating AI. In fact, its AI features are already generating over $5 billion in annual recurring revenue, which is more than half of Anthropic's ARR.

2) Its moat is huge. Over 98% of the Fortune 500 use Adobe, and like other software solutions, the product is so deeply integrated into the entire creative workflow that it's difficult to switch solutions. It's so ubiquitous that most digital creative roles list Adobe proficiency as a job requirement. An additional tailwind is short-form video. Adobe Premiere Pro is the industry standard for video editing, and most media companies (including ours) are significantly expanding short-form video budgets as this medium continues to explode.

2. Salesforce

Salesforce is another AI-enabled company that's considered dead.

Meanwhile, the ARR for its AI agent products quadrupled last quarter, and the company continues to be rated #1 most trusted CRM in the industry. It's down over 40% in the past year, its P/E ratio is now below the S&P average, and its price-to-cash-flow ratio is about half its 5-year average.

Even if Claude has a more interesting product, I don't believe this outweighs the massive switching costs—certainly not in the time it would take Salesforce to build its own comparable product.

3. ServiceNow

ServiceNow has been hit hard this year—down about 30% in 2026.

The consensus is that growth is about to end. Meanwhile, its fundamentals tell the opposite story: subscription revenue grew 21% last quarter, total revenue grew 20%. As for its AI capabilities, ServiceNow has more than enough.

In fact, the company is on track to generate $1 billion in revenue from its AI products this year. It has also signed multi-year partnerships with OpenAI and Anthropic—more evidence that the AI revolution is not a zero-sum game.

I believe both OpenAI and Anthropic will grow significantly this year, and so will ServiceNow.

4. Microsoft

If you listened to yesterday's podcast, you'll notice I didn't mention Microsoft. That's because I hadn't bought it yet when recording.

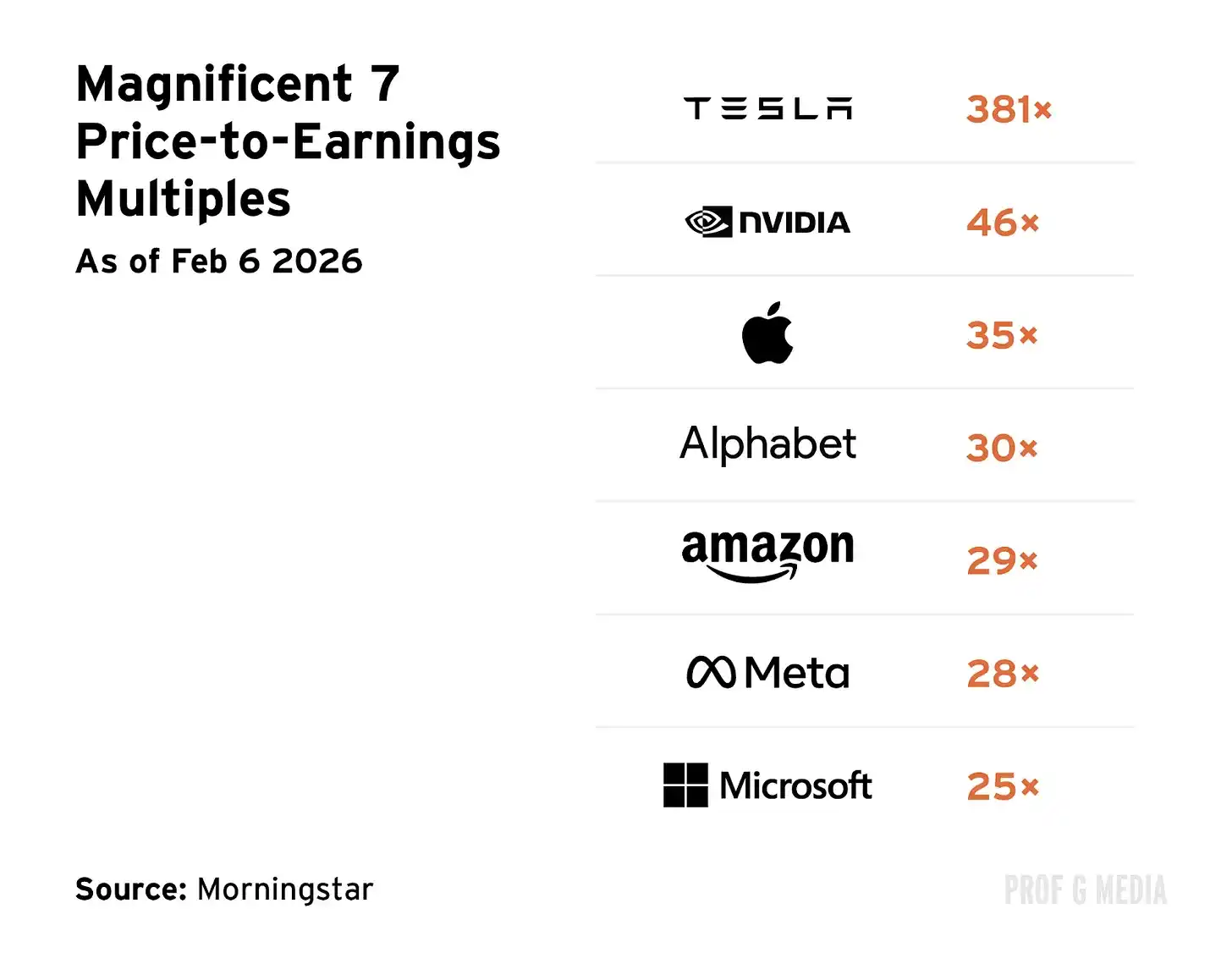

My initial thought was that I didn't need Microsoft because my exposure was already large. (MSFT is 5% of the S&P 500.) However, upon reflection, I decided the valuation was too cheap to ignore.

At the time, Microsoft's P/E ratio was only 25, the lowest among the Mag 7. This is relatively absurd for the reasons I highlighted above, and especially absurd for another key reason: Microsoft owns nearly a third of OpenAI.

Even if Microsoft's lunch is being eaten (which I doubt), the company has contractual rights to be compensated. Few companies are better positioned in AI than Microsoft. The current price does not reflect this.

Efficient Market Hypothesis

For the most part, I believe in the Efficient Market Hypothesis—the concept that the market reflects all available information and is smarter than any individual. I have great respect for the market's predictive power (especially after they correctly predicted 93% of Golden Globe winners). I don't claim to be smarter than them.

However, I also believe that every once in a while, something extraordinary happens—a political event, a natural disaster, a global pandemic, or indeed, the arrival of a transformative technology. In these cases, I believe the market can lose its mind. When that happens, for a brief period, the Efficient Market Hypothesis fails.

I risk being wrong and losing money here. But that's what being an investor is about. Plus, if you don't take a little risk from time to time... what's the fun in that?

See you next week,

Ed